,

, more than 14 million people in Shanghai have carried out antigen detection. Its advantages of fast speed and simple operation form an important supplement to nucleic acid detection, Shanghai has launched a new round of nucleic acid screening,

, ,

,

,

,

, ,

and

. More than 14 million people in Shanghai have carried out antigen detection. Its advantages of fast speed and simple operation form an important supplement to nucleic acid detection.

has launched a new round of nucleic acid screening

and

antigen detection in Shanghai. Over 14 million people have been screened for

and

in March 27th. According to the “WeChat issue” WeChat official account, to prevent the spread and spread of the epidemic and protect the safety and health of the people, we should quickly achieve zero social status, and comprehensively evaluate the previous rounds of nucleic acid screening and assess it by experts. The leading group of novel coronavirus pneumonia epidemic prevention and control research decided to launch a new round of mesh type and grid nucleic acid screening in the city.

and

at the press conference on epidemic prevention and control on the same day, Wu Ganyu, a first-class inspector of Shanghai Municipal Health Commission, introduced the progress of antigen detection in non key areas of the city. She said that at present, more than 14 million people have been tested for antigen in the city and will continue to be carried out. Some people who were positive for antigen detection were found, and their nucleic acid detection and control were carried out immediately. The advantages of fast antigen detection and simple operation were reflected. In March 11th, with the issuance of the COVID-19 antigen detection application plan (Trial) by the national health and Health Commission (

), the new crown antigen detection reagent was officially approved in China in March 11th. As of March 23rd, the State Food and drug administration has approved 19 COVID-19 antigen detection reagent products.

North funds, lithium, fund, stock, coal plate, real estate stocks, bulk, limit, early, Baijiu  ,

,

Zhejiang Securities believes that the current global advantage strain of the drug is highly infectious and short incubation period, therefore, the original detection will be an important supplement to nucleic acid detection to be promoted. The core purpose of the government guided price of reagents is to promote large-scale application as soon as possible and combat the epidemic, focusing on “large-scale” rather than “price limit”. At the same time, the large-scale use of relevant policies and regions, especially in areas with serious epidemic situation, marks that the application scenario is accelerating, and the market still has great potential on the whole.

and

Zhongtai Securities said that referring to the overseas distribution policy, it is predicted that the domestic market scale may reach 17.7-26.6 billion yuan in a single month. Taking into account the purchase of residents and enterprises at their own expense, it is expected that the purchase demand of neocoronavirus antigen testing products is expected to further increase.

and

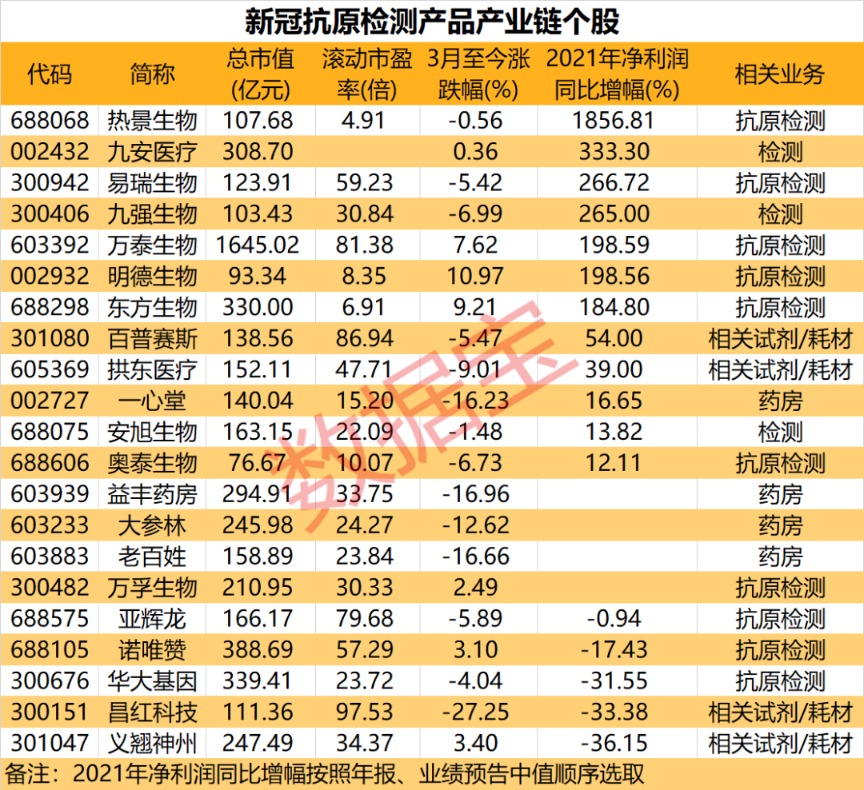

Securities Times · databao sorted out the list of individual stocks in the industrial chain of neocoronavirus antigen detection products, and 21 stocks were listed. Among them, the stocks whose related business is “antigen detection” are listed companies whose antigen detection reagents have been approved by the State Food and drug administration, with a total of 10. Since March, three antigen detection stocks of Mingde biology, Dongfang biology and Wantai biology have risen by more than 7%; Four Pharmacy Stocks collectively corrected, with a decline of more than 12%.

,  and

and

are calculated based on the median value of the annual report / forecast interval, and the annual performance of most testing stocks increased significantly. The net profit of rejing biology increased by more than 18 times year-on-year, and the net profit of six shares of Jiuan medical, Yirui biology, Jiuqiang biology, Wantai biology, Mingde biology and Dongfang biology doubled. Institutions pay high attention to Yifeng pharmacy, Yixintang, nuovizan and other stocks, and there are more than 15 rating agencies. The annual report of six shares of

and

and the net profit of the first quarterly report have doubled. The

and

will run out in March, and the pre increase market of the first quarterly report has quietly kicked off. According to the statistics of data treasure, since last Friday, 18 shares have successively released the performance forecast for the first quarter of 2022. From the type of notice, only one share of shuobaid is pre reduced, and the rest are pre increased or slightly increased. Based on the median value of the forecast interval, the net profit of 8 shares is expected to double year-on-year. Tibet Mining, Tongwei shares and Xingfa group were firmly in the top three positions, and their net profits increased by more than 370%; Since then, the net profits of boten and wanweigaoxin have increased by more than 190%.

,  and

and

Tibet Mining said that during the reporting period, the sales volume of lithium salt products of the company increased, and the lithium profit increased significantly, which led to a significant increase in performance; Tongwei Co., Ltd. said that due to the higher than expected photovoltaic installation and strong demand for polysilicon, the volume and price of the company’s products increased simultaneously, so as to realize the double increase of volume and profit in the first quarter; Xingfa group benefited from the continued high prosperity of the industry and the completion and operation of equity participation projects, and its net profit increased significantly year-on-year. In terms of

and

, the latest prices of 7 shares have retreated by more than 20% compared with the highs of the year, and shuobaid, Tibet Mining and xinyichang have retreated by more than 25%; In terms of valuation, the latest rolling P / E ratios of Nanshan aluminum, frantec, Shandong fiberglass, wanwei hi tech and Xingfa group are low, all less than 15 times; In terms of institutional attention, the number of pelaya rating agencies ranks first, up to 43; Tongwei shares, power diamond and Guolian shares were rated by more than 20 institutions.

and

it is worth noting that six shares of Xingfa group, Changchang lithium technology, Tibet Mining, power diamond, nano micro technology and Tongwei shares showed high growth in 2021 and the first quarter of this year, with a year-on-year increase in net profit of more than 100%. Among them, Xingfa group and Tibet Mining Group performed best, and the net profit in the annual report and the first quarter exceeded 370% year-on-year.

(source: Securities Times)