, after the silent period of the annual report, companies such as Xiaomi started a new round in the face of the decline of Internet share prices, On the evening of March 24, Xiaomi group said that the company purchased 3409400 shares of the company at a price of HK $14.44 to HK $14.5 per share, at a cost of nearly HK $50 million. On the evening of the 22nd, Xiaomi group released its latest repurchase plan, which will buy back its shares on the open market at a maximum amount of HK $10 billion from time to time.,

after the silent period of the annual report, in the face of the decline in Internet share prices, companies such as Xiaomi began a new round.

and

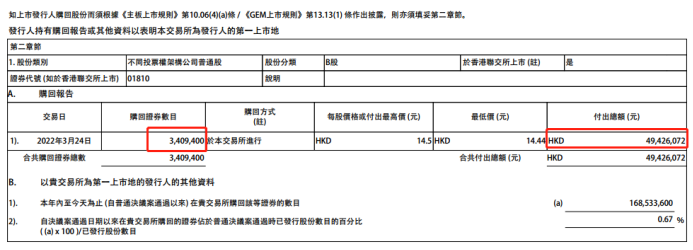

on the evening of March 24, Xiaomi group said that the company acquired 3409400 shares of the company at a price of HK $14.44 to HK $14.5 per share, at a cost of nearly HK $50 million. On the evening of the 22nd, Xiaomi group released its latest repurchase plan, which will buy back its shares on the open market at a maximum amount of HK $10 billion from time to time.

and

before that, it also announced that the upper limit of stock repurchase scale was raised to US $25 billion (equivalent to nearly 160 billion yuan). After the closing of

and

on March 24, Tencent announced the grant of share options, saying that the company granted a total of 7.262 million share options under the 2017 share option plan on March 24, 2022, with an exercise price of HK $384.08 per share and a closing price of HK $366 per share on the date of grant. The market analysis of

and

points out that as the share price of Internet enterprises has fallen a lot, repurchase will become one of the most important means for enterprises to stabilize the share price. After the earnings silence period, enterprises may increase their repurchase. However, in the long run, the stability of the company’s share price mainly depends on the stability of the company’s fundamentals and the improvement of profitability to promote the growth of the company’s value.

and

Xiaomi started a new round of stock repurchase. Just after

and

announced a HK $10 billion repurchase plan, Xiaomi immediately began to take action.

and

on the evening of March 24, Xiaomi group issued the latest announcement that the Company repurchased 3409400 shares at the price of HK $14.44 to HK $14.5 per share on March 24, at a cost of about HK $49.426 million. This means that Xiaomi group has opened a new round of stock repurchase. According to past practice, the company’s next repurchase action will be more frequent.

,  and

and

on the evening of March 22, Xiaomi group released the announcement of share repurchase plan while publishing the financial report. Xiaomi group said that the board of directors formally resolved to exercise the share repurchase authorization to repurchase shares in the open market from time to time with a maximum total amount of HK $10 billion. The company will repurchase shares in accordance with the listing rules. The board of directors of

and

Xiaomi Group believes that the share repurchase under the current situation can show that the company is full of confidence in its business outlook and prospects, and will eventually bring benefits and create value for the company. The board of Directors believes that the company’s existing financial resources are sufficient to support share repurchases while maintaining a sound financial position.

and

in fact, Xiaomi has thrown out stock repurchase plans many times since its listing. On September 2, 2019, the board of directors of Xiaomi group decided to exercise the share repurchase authorization to repurchase shares in the open market with a maximum total price of HK $12 billion. On March 11, 2021, the board of directors of Xiaomi group decided to exercise the share repurchase authorization and repurchase shares in the open market at a maximum amount of HK $10 billion from time to time. A year later, on March 22, 2022, Xiaomi announced that it would buy back the company’s shares from time to time with a maximum total amount of HK $10 billion.

and

according to the statistics of the times, after the announcement of the repurchase plan of HK $10 billion in 2021, Xiaomi group carried out 65 repurchase times, with a total repurchase of 356 million shares at a cost of HK $8.65 billion, close to the upper limit of the repurchase amount.

and

will Tencent follow up the repurchase?

just before Xiaomi started a new round of stock repurchase, Alibaba, one of the Internet giants, threw out a huge repurchase plan.

and

on March 22, 2022, shortly after the announcement of 2021, Alibaba announced that it would increase the share repurchase scale from US $15 billion to US $25 billion. This is also Alibaba’s largest repurchase plan in history, and also set a new record for the repurchase scale of zhonggai shares.

in addition, the group also announced at the end of 2021 that the board of directors of the company had approved the modification of the existing share repurchase plan, increasing the authorization of the repurchase plan from US $2 billion to US $3 billion and extending it to March 17, 2024.

and

make the market have high expectations on whether Tencent will increase its repurchase. On the evening of March 23, the annual results of 2021 were announced, with a slight increase of 1% year-on-year, the lowest increase in net profit in recent ten years. Tencent’s total revenue in 2021 was 560.118 billion yuan, a year-on-year increase of 16%; The net profit was 224.82 billion yuan, a year-on-year increase of 41%; The adjusted net profit was 123.788 billion yuan, a year-on-year increase of 1%.

price rise, news, a shares, daily limit tide, agricultural stocks, e-commerce, strength, morning trading, daily limit, capital

. However, after the performance announcement, Tencent did not follow Alibaba and Xiaomi to announce stock repurchase. On March 24, Tencent’s share price fell again, down nearly 6%.

and

for share repurchase, Tencent said that in the past few months, it has been actively distributing JD shares, actively repurchasing shares in the market, and also announced regular dividends. “These are our three ways to give back to shareholders.” According to the data of

and

, Tencent has carried out a round of intensive stock repurchase in January this year. After the closing of

,  and

and

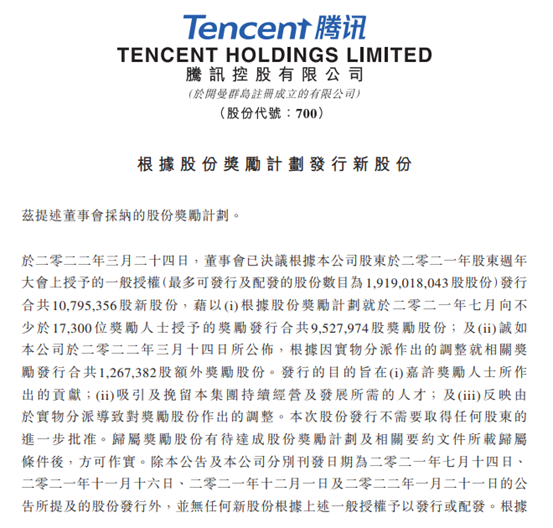

on March 24, Tencent announced the grant of share options, saying that the company granted a total of 7.262 million share options under the 2017 share option plan on March 24, 2022, with an exercise price of HK $384.08 per share and a closing price of HK $366 per share on the date of grant. It is equivalent to Tencent issuing a 7-year call option. The company grants employees HK $384.08 per share to buy Tencent holdings in the next 7 years. The employee’s income is the difference between the actual stock price and the exercise price. In fact, it also indirectly sends a signal to the market that “the current share price is undervalued”.

and

Tencent distributed HK $4 billion red envelopes

and

. At the 2021 annual general meeting of shareholders, Tencent presented to 17300 people on March 24, 2022The employees distributed 10.7954 million shares. According to the closing price on March 24, the incentive value of the above shares was HK $3.951 billion, with an average value of HK $228400 per person.

and

according to the share award plan, Tencent will issue a total of about 9.528 million bonus shares for the awards granted to no less than 17300 people in July 2021, and issue a total of about 1.2674 million additional bonus shares for the relevant awards due to the adjustment of in kind distribution.

,  and

and

itemize the process of equity incentive of Tencent in recent years. In order to motivate and retain employees, Tencent has repeatedly distributed equity incentive red envelopes. In July 2020, Tencent rewarded 29700 employees with 26640700 shares; In 2021, when the share price was depressed, Tencent issued equity incentive shares to employees in July, November and December respectively; In January 2022, Tencent issued 8.048 million equity incentive shares to 22800 employees. This time, it distributed 10.7954 million new shares to 17300 employees, which is the second time in the year to issue employee stock incentive red envelopes. The purpose of equity incentive in

and

companies is to motivate and retain employees, improve company performance and reduce employee turnover rate. For employees, getting a satisfactory salary is one of the criteria for choosing a job.

and

believe that in the current environment, although Tencent still faces the impact of regulatory policies such as, data security and antitrust, and continues to invest in key areas such as international games, video numbers, cloud and enterprise software, it is expected to put pressure on the short-term profit growth, but in the medium and long-term dimension, the company is expected to form stronger competitiveness in the above areas.

and

in fact, Tencent is also continuously improving efficiency and optimizing costs and expenses. CITIC Securities research points out that Tencent is expected to present a more stable profit structure and achieve healthy and sustainable growth in the future. With the introduction of Internet related regulatory policies, the industry policy orientation is expected to become clearer in the future, and the company’s share price still has room for continuous upward growth in the medium and long term.

and

how cost-effective is the valuation of Hong Kong stocks?

with the decline of relevant stock prices in the Hong Kong stock market, more and more companies have joined the team of repurchase. In addition to the active repurchase of Internet companies, among the companies participating in the repurchase this year, there are well-known enterprises in the industry such as,,, and new economy companies including.

and

Hong Kong listed companies set off a wave of repurchase. In the view of the market, they can convey investors’ confidence in future development, help the company’s share price match the company’s internal value, and also play a vital role in maintaining the stability of share price. Stock repurchase is also the stock source for the company to implement equity incentive or employee stock ownership plan. When the stock price is depressed, repurchase helps to reduce the cost of equity incentive.

and

studies pointed out that the current valuation of major indexes in the Hong Kong stock market is generally below the historical central level, and is also at a low level in major global markets. The Hong Kong stock market is now in a valuation depression and prominent allocation value after experiencing oversold.

and

Founder Securities believe that the price to book ratio of the Hang Seng index was once as low as 0.88 times at the closing on March 15, approaching the lowest level in the past 20 years. After a rapid rebound, it is still in the historical quantile of 7% from the bottom up. Compared with the historical data of Hong Kong stocks, the current valuation is near the bottom of the average minus double the standard deviation. At present, Hong Kong stocks are in the range of downward support and upward space.

in addition, from the perspective of ah premium index, A-share market ushered in a round of rapid adjustment at the beginning of 2022, while Hong Kong market rose against the trend, resulting in a slight decline of ah premium index. However, from the long-term history of more than ten years, the current ah share premium is still high, and the valuation cost performance of the Hong Kong stock market is prominent.

and

said that after the roller coaster market, the panic selling in the early stage of the Hong Kong stock market may come to an end temporarily, and the market will gradually enter the bottom period of consolidation. However, the recovery of sentiment still needs some time after all, mainly considering: 1) the outflow of overseas funds, especially the reduction of large sovereignty, is difficult to reverse significantly in the short term; 2) The proportion of short selling in the market remains high; 3) Geopolitical tensions, Sino US relations, the epidemic, domestic policy and regulatory uncertainty have not been completely weakened. Therefore, looking ahead, the sustainability of the market rebound may depend on: 1) whether the positive policy signals are implemented; 2) Whether the external uncertainty will be alleviated.

related reports

(source: Securities Times)