Education, Smartphone, Advertisement, Intelligent Office, Laptop, Smartphone, Wireless Conference, Wireless Synchronizing Screens

Since March, the market has continued to fluctuate, and the annual reports have been disclosed one after another. Star managers are actively participating in further communication with listed companies on performance. Specifically, Zhang Kun investigated the concept unit of assisted reproduction, Xie Zhiyu, housewarming “heparin leader”, “API export leader”, Feng Mingyuan “footwear leader”, Yang Yu, GUI Kai and other researchers “Automotive software leader”, Cao Mingchang and so on.,, For the second time in the year, Zhang Kun investigated the concept stocks of assisted reproduction. Since March, the market has continued to fluctuate, and the annual reports have been disclosed one after another. Star managers are actively participating in further communication with listed companies on performance. Specifically, Zhang Kun investigated the concept unit of assisted reproduction, Xie Zhiyu, housewarming “heparin leader”, “API export leader”, Feng Mingyuan “shoe leader”, Yang Yu, GUI Kai and other researchers “automobile software leader”, Cao Mingchang and so on.

the second

Zhang Kun survey of assisted reproduction concept stocks

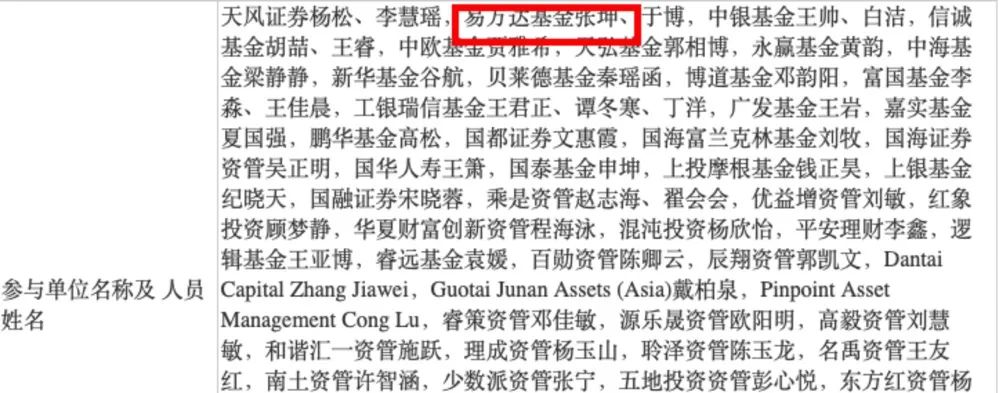

recently, St national medicine showed that Zhang Kun, a 100 billion top flow fund manager, participated in a teleconference exchange. This is the second survey this year, and St national medicine in the assisted reproduction sector was still selected. The

,  and

and

reporters found that Zhang Kun has been paying attention to the assisted reproduction sector for a long time. Since the middle of 2020, Hong Kong listed companies have been listed in the positions of e-fund blue chip selection fund managed by Zhang Kun for three consecutive quarters. However, in the first quarter of 2021, Zhang Kun once greatly reduced his holdings of Jinxin reproduction. By the end of the second quarter of 2021, e-fund for high-quality enterprises managed by him held 19 million shares of Jinxin reproduction, The month on month reduction rate exceeded 60%. However, as of June 30, 2021, e Fangda still held 175 million shares of jinxinreproductive and Hillhouse capital held more than 300 million shares. In terms of the share price of

and

Education, Smartphone, Advertisement, Intelligent Office, Laptop, Smartphone, Wireless Conference, Wireless Synchronizing Screens

, since this year, St Guoyi has fallen by more than 26%.

Xie Zhiyu, Jianyou Co., Ltd. “heparin leader” and

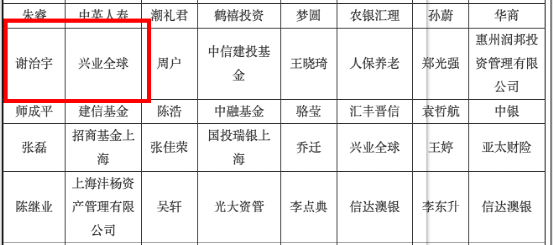

of Puluo Pharmaceutical Co., Ltd.” API export leader “recently, Jianyou Co., Ltd. issued an announcement that Xie Zhiyu, qiaoqian and Mengyuan, manager of Xingzheng Global Fund, participated in the company’s research. In addition, 56 institutions including, companies, others, companies and sunshine private placement institutions participated in the survey.

,  and

and

as of the fourth quarter report, Jianyou shares were still among the top ten stocks of Xie Zhiyu’s Fund. According to the public information of

,  and

and

, Jianyou Co., Ltd. has been engaged in the production of standard heparin sodium since the 1990s and has gradually developed into the leader of heparin sodium API. Since this year, the share price of Jianyou has fallen by more than 22%.

and

reporters noted that in addition to Jianyou shares, Xie Zhiyu, Qiao Qian and Tong Lan also participated in the video conference held by Puluo pharmaceutical, the leader of API export, in the middle of this month. According to the 2021 annual report released by

and

Puluo Pharmaceutical Co., Ltd., Xingquan Heyi, managed by Xie Zhiyu, reduced its holdings of 1077100 shares in the fourth quarter. During the fourth quarter, Xingquan Herun increased its holdings, while Xingquan Heyi decreased its holdings. Between one increase and one decrease, Xie Zhiyu’s two funds held PLO pharmaceutical as a whole, with a total market value of 1.742 billion yuan. It is worth noting that in the third quarter of last year, Xie Zhiyu significantly reduced his holdings of PLO pharmaceutical, among which Xingquan Herun reduced its holdings of 4.074 million shares and Xingquan Heyi reduced its holdings of 10.5569 million shares. According to the public information of

,  and

and

, Puluo Pharmaceutical Co., Ltd. is a large comprehensive pharmaceutical enterprise integrating API intermediates, R & D and production (cdmo), preparation R & D, production, operation and trade. According to the annual report of

and

Puluo pharmaceutical in 2021, it achieved 8.943 billion yuan during the reporting period, with a year-on-year increase of 13.49%; 956 million yuan attributable to listed companies, a year-on-year increase of 17%.

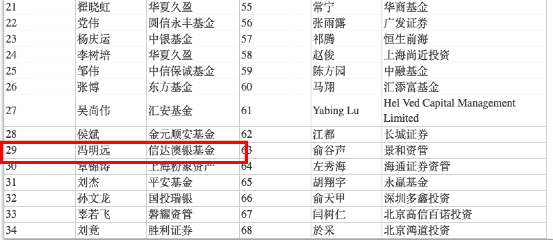

Feng Mingyuan investigated “shoes leader” Aokang international

Aokang international issued an announcement on March 22. (now: Cinda Australia Fund) Feng Mingyuan, Ma Xiang and other fund managers from 68 institutions participated in the investigation. The reporters of

,  and

and

noted that at the beginning of this year, Ruiyuan fund, as one of the “top streams” in the public offering market, also appeared in Aokang international research.

and

Aokang international, founded in 1988, are well-known operators and retailers of leather shoes in China. At the end of February, investors asked Aokang international whether Aokang international produced military related shoes? In this regard, aokangguo said on the investor interaction platform that the company’s military shoe group purchase business has been carried out for many years and belongs to the company’s regular business. In terms of

and

, Aokang international financial report shows that in the first three quarters, the company achieved an operating revenue of 2.143 billion yuan, a year-on-year increase of 36.95%, a net profit of 45.239 million yuan, a year-on-year increase of 385.94%, and a net profit of 15.1525 million yuan after deduction. In terms of

and

Education, Smartphone, Advertisement, Intelligent Office, Laptop, Smartphone, Wireless Conference, Wireless Synchronizing Screens

, Aokang international has fallen by more than 16% in the year.

Yang Yu and GUI Kai investigated the

of China’s gold

and

. In addition, the on-site meeting of China’s science and technology Chuangda also attracted the participation of Yang Yu, GUI Kai and Guo Xiaowen of huitianfu fund and CNPC fund.

and

reporters found that by the end of 2021, Harvest Fund had 14 products holding Zhongke Chuangda, accounting for 6.81% of the circulating shares. Among them, all 8 funds under Kai’s management hold shares of Zhongke Chuangda. Harvest emerging industry, harvest

and

core growth and harvest vision selection are the seventh, eighth and tenth largest shareholders of Zhongke Chuangda respectively.

and

Guo Xiaowen also holds Zhongke Chuangda in the new idea of China Post management, but the number of shares is small. Yang Yu has no position for the time being. In

and

, kechuangda is a leading provider of intelligent platform technology. According to the annual report of 2021, the company achieved an annual operating revenue of 4.127 billion yuan, a year-on-year increase of 57.04%The revenue of energy-saving software, intelligent Internet connected vehicle and intelligent Internet of things increased by 40.33%, 58.91% and 82.87% respectively year-on-year.

and

since this year, the stock price of Zhongke Chuangda has fallen by more than 24%.

and

in addition, the China Gold video research conference attracted well-known fund managers and institutional investors such as Cao Mingchang and Ruiyuan fund. China gold is a well-known central enterprise in the field of gold and jewelry sales in China. As far as Cao Mingchang does not hold shares in the company at present, this is his first investigation of the company.

recommends reading

(source: China fund daily)