Good news: increase the position of a shares! Global emerging market funds, office projection, miracast,

data from Copley fund research, a global institution, showed that as of the end of February, A-share positions in global emerging markets had quietly reached a new high. This shows that China is still attractive to emerging market funds in 2022. At the same time, the data also showed that the interest of overseas funds in zhonggai Internet company rebounded. However, under the high volatility market, the position of hedging positions is also increasing, Copley fund research is the founder and CEO of a fund research institution in the United States. Steven Holden worked in investment for 18 years before founding Copley fund research, and worked in institutions such as Morgan Stanley and Citigroup.,

data from global institution Copley fund research showed that as of the end of February, the A-share position in global emerging markets had quietly reached a new high. This shows that China is still attractive to emerging market funds in 2022. At the same time, the data also showed that the interest of overseas funds in zhonggai Internet company rebounded. However, under the high volatility market, the position of hedging positions is also increasing.

Copley fund research is the founder and CEO of a fund research institution in the United States. Steven Holden worked in investment for 18 years before founding Copley fund research and worked in institutions such as Morgan Stanley and Citigroup.

and

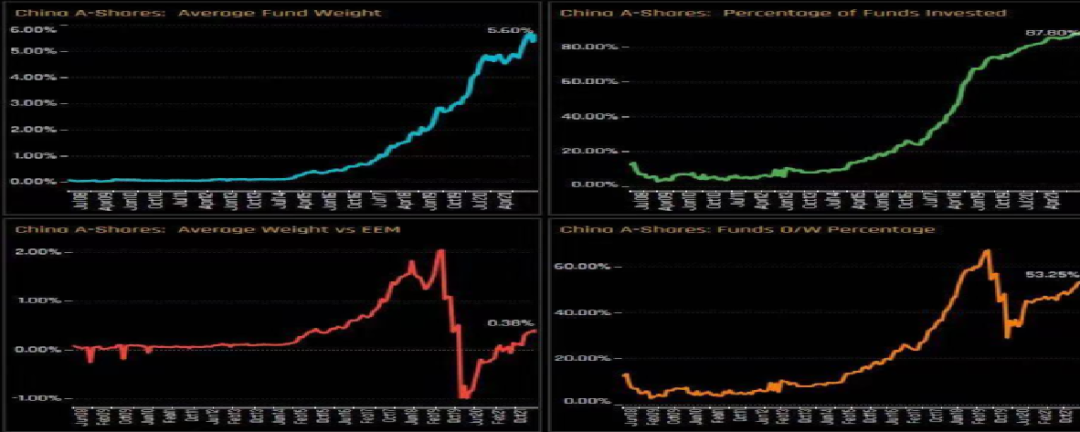

data from Copley fund research show that as of the end of February 2022, the A-share positions of actively managed funds in global emerging markets have increased significantly. Reflected in two aspects: first, for emerging market funds with a shares, the proportion of a shares in fund assets rose to a record high of 5.6%, while the proportion of funds with a shares in the total number of emerging market active funds also rose to a record high of 87.8%. In addition, more than half of the emerging market active funds are in a state of over allocation to a shares, that is, the proportion of A-share assets in the total assets of these funds is higher than the benchmark. Some small partners of

and

will ask: Why are only 5.6% of the assets of these funds invested in a shares. Because the proportion of a shares in the benchmark of these funds is still very low, the proportion of a shares of funds is not high. However, vertically, the fund’s allocation of a shares has been significantly improved. The following four pictures of

and

are provided by Steven holden to the fund. The first picture of

and

represents the proportion of a shares allocated in emerging market active funds, which has risen to a new high. The second picture of

and

shows the number of A-share funds invested in all emerging market funds, which also rose to a new high. The third picture of

and

shows the comparison between the average proportion of a shares in emerging market active funds and MSCI Emerging Market Index (EEM tracks MSCI Emerging Market Index). The proportion of a shares in emerging market active funds is 0.38 percentage points higher than that of EEM. The fourth chart of

and

shows that 53.25% of emerging market active funds have oversubscribed A shares.

,  and

and

source: is the data provided by Steven Holden

and

convincing?

in order to answer this question, the fund gentleman consulted Steven Holden.

and

fund Jun: are these conclusions representative enough?

Steven Holden: conclusion based on our emerging market fund research, it covers 246 actively managed emerging market funds, with a total management scale of US $500 billion. It is hard to say what proportion of all emerging market funds these funds account for. But we cover all large emerging market funds registered in the United States, the United Kingdom and other European countries.

and

fund Jun: what are the changes in the A-share investment of emerging market funds compared with a year ago?

Steven Holden: by the end of February 2022, the proportion of a shares allocated with a shares in emerging market funds in fund assets had risen to a record high of 5.6%, and the proportion of funds allocated with a shares in the total number of emerging market funds had also risen to a record high of 87.8%. A year ago, funds with a shares were allocated in emerging market funds. The proportion of a shares in fund assets was 4.67%, and 85% of emerging market fund positions included a shares. It can be seen that the number of funds investing in a shares in emerging market funds has increased in the past year, and the position of a shares in these funds has also increased.

Steven Holden: last year, the allocation of a shares by active management funds in emerging markets increased significantly. For example, since 2008, the total amount of funds flowing into a shares by active funds in emerging markets has been US $14 billion, but US $5 billion has flowed in the past year.

Steven Holden: if we broaden our horizons to more funds, including global market funds (whose investment scope is the global market), Asian (excluding Japan) market funds and actively managed Chinese funds, US $67 billion of these funds have gone to a shares in the past five years, most of which have gone to a gold (A-share funds issued overseas).

zhonggai shares, supervision, overseas, channel, audit, listing, institution, China Securities News, exclusive, investment

Steven Holden believes that from the end of August 2021 to the end of February 2022, the capital will turn to a shares. During the period, the average position of a shares of emerging active funds increased by 0.84 percentage points; 2.44% of emerging market active funds newly bought a shares; The fund with over allocation of a shares increased by 4.07 percentage points.

,

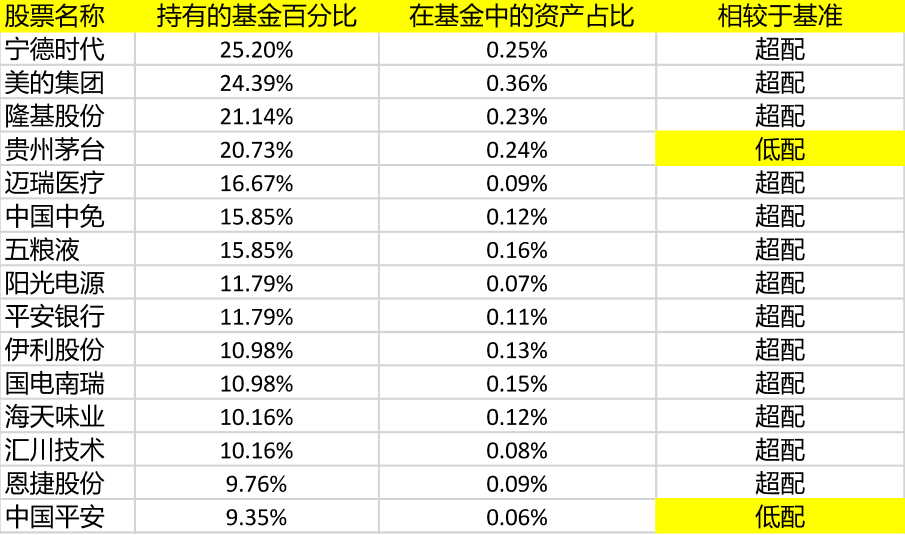

and “ningwang” are the most popular. According to the data from Copley fund research, in terms of the number of funds held, “ningwang” is the most popular stock among emerging market active funds, followed by,. In terms of the number of active funds held in emerging markets alone, “ningwang” completely defeated “maowang”. However, if considering the amount allocated to the stock, “maowang” still wins.

,  ,

,

sort out

and

according to the data of Copley fund research, which may be related to the market value of Maotai.

and

, two of the 15 stocks most invested in emerging markets, are underpriced. In other words, although the number of funds bought is quite large, compared with the benchmark, everyOnly the amount of funds to buy is still small. These two underpriced stocks are and.

and

what stocks have emerging market active funds increased their positions in the past six months?

,  and

and

source: Copley fund research

and

data show that from the end of August 2021 to the end of February 2022, Ningde era,,,,,,, was built by the most new funds Moutai, Guizhou, Ping An, China, were withdrawn by the most funds. The data above

and

show that although the situation in Russia and Ukraine has begun to deteriorate in late February, emerging market funds have not withdrawn from a shares.

and

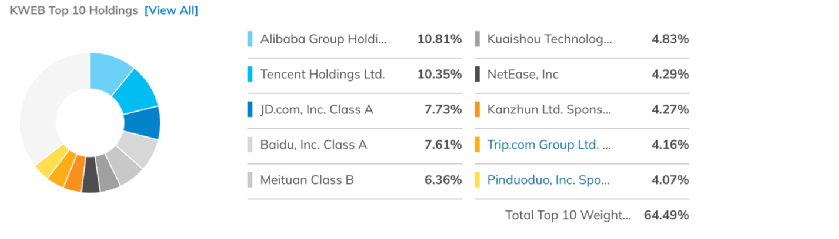

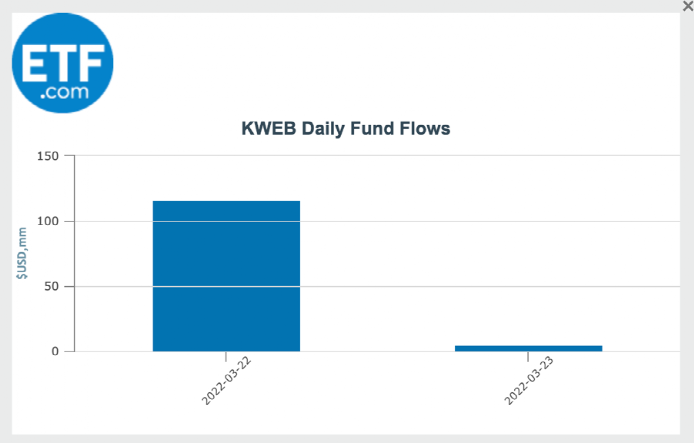

funds returned to overseas China concept Internet ETF

and

, the second largest Chinese ETF listed in the United States. Kweb, which tracks China’s Internet Index, received funds returned this week and has attracted us $120 million. The ETF is the latest $5 billion 890 million, which includes the fund, Tencent, Kwai, USA, fast, accurate, and other Internet giants.

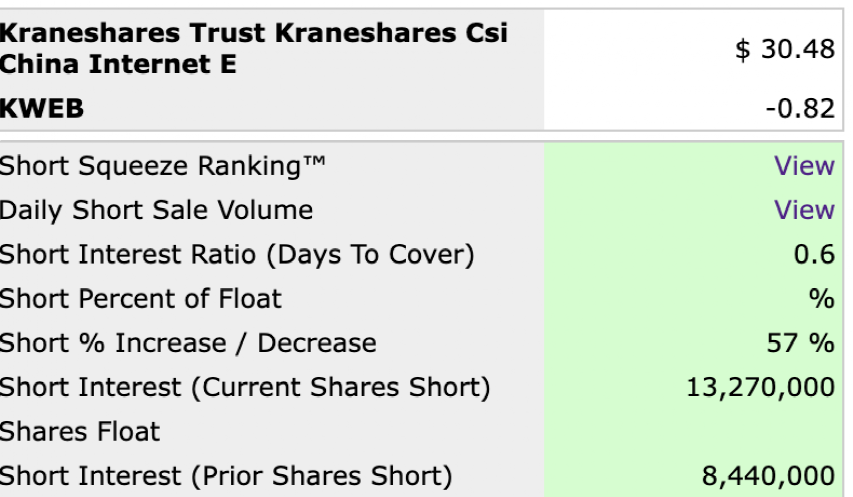

however, it is worth noting that despite the increase in net capital inflows, kweb’s short positions are also increasing significantly. For example, short squeeze, a website that tracks short positions, showed that as of March 25, kweb’s short positions were 13.27 million shares, up 57% from the previous day.

source: short squeeze

is a significant net capital inflow on the one hand and a sharp increase in short interest on the other. This shows that although the funds are more interested in kweb Zhongyu Internet, they also believe that kweb will still face fluctuations in the future, so many institutions also use hedging to protect their positions.

and

value investors Nuggets China’s

and

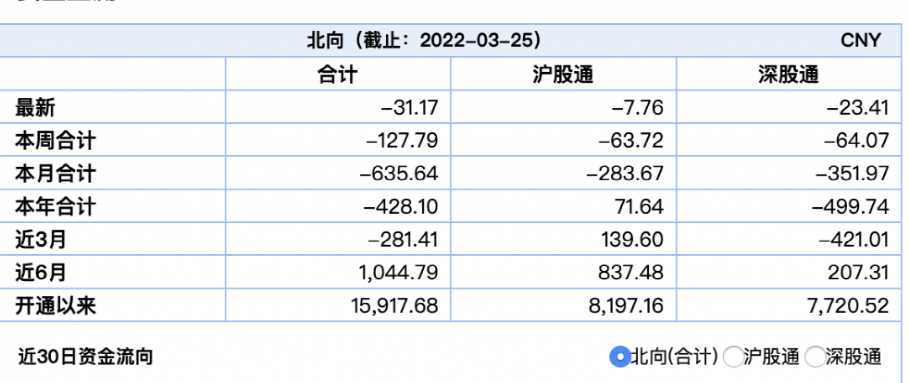

had a net outflow of 63.564 billion yuan from the north as of March 25. The Institute of

,  and

and

sorted out the net outflow of funds in the north for six times in history and found that the range of this net outflow is relatively large. CAITONG securities explained that the Fed raised interest rates, “Russia Ukraine conflict” and concerns about “stagflation”. Geopolitics is still a worry for overseas funds. Daniel J. OKeefe, the fund manager of the global value group of artisan partners, an investment agency of

and

, believes that Alibaba and other companies are too cheap at present. “It’s probably the cheapest company I’ve ever seen in the world with the same quality and financial quality,” he said. At present, the market has given it a sky high risk premium. This means that the market has fully priced the negative factors. Although Alibaba’s business is still affected by some cyclical factors, Alibaba’s business will come back with China and economic recovery. Wang Lei, managing director and fund manager of

and

, also told reporters that the regulatory uncertainty most worried by overseas investors investing in these Internet companies has been largely eliminated.

(source: China Fund News)