On the morning of March 25, Dan bin, chairman of Shenzhen Oriental harbor investment, personally responded to the “suspected short position” report released in the early morning of China, saying that the report was written objectively. He said that in fact, every major decision is not easy. We have to pay considerable “mental” and bear the corresponding consequences and outcomes., For Dan Bin’s “short positions”, many private placement told Chinese reporters of securities companies that on the one hand, their products have avoided the recent sharp decline in the market and the pain of passive position reduction due to excessive product withdrawal, which is a responsible attitude towards customers; On the other hand, from the perspective of medium and long-term returns, it is currently the bottom area, and the risk of short positions is greater than that of high positions., Some investors said that Dan bin has cleared his position and the bull market is not far away. In the second half of 2018, Dan bin once sold Maotai and other stocks. He was short for nearly half a year, which seems to be the bottom of history. Fortunately, he bought it back later., This week, the stock market continues to fluctuate at a low level, and a number of private placement products may touch the early warning line and liquidation line, increasing investment pressure. According to the data of private placement network, as of March 25, there were 5842 private placement products with a cumulative net value of less than 0.85, 4162 products with a cumulative net value of less than 0.8 yuan and 2949 products with a cumulative net value of less than 0.75 yuan., On the morning of

on March 25, Dan bin, chairman of Shenzhen Oriental harbor investment, personally responded to the “suspected short position” report released in the early morning of China, saying that the report was relatively objective. He said that in fact, every major decision is not easy. We have to pay a considerable “mind” and bear the corresponding consequences and outcomes.

,  and

and

for Dan Bin’s “short position”, many private placement told Chinese reporters of securities companies that on the one hand, their products have avoided the recent sharp decline in the market and the pain of passive position reduction due to excessive product withdrawal, which is a responsible attitude to customers; On the other hand, from the perspective of medium and long-term returns, it is currently the bottom area, and the risk of short positions is greater than that of high positions. Some investors in

and

also said that Dan bin has cleared his position and the bull market is not far away. In the second half of 2018, Dan bin once sold Maotai and other stocks. He was short for nearly half a year, which seems to be the bottom of history. Fortunately, he bought it back later.

and

this week, the stock market continued to fluctuate at a low level, and a number of private placement products may touch the early warning line and liquidation line, increasing investment pressure. According to the data of private placement network, as of March 25, there were 5842 private placement products with a cumulative net value of less than 0.85, 4162 products with a cumulative net value of less than 0.8 yuan and 2949 products with a cumulative net value of less than 0.75 yuan.

,

Buffett, musk and other investment masters all said that the most important thing in investment is to survive. Value investors represented by Duan Yongping firmly believe in Buffett’s “three no principles”, that is, do not short, do not borrow money and do not understand.

and

however, although the current investment is very difficult, when most investors and institutions can not afford it, the market is often not far from the bottom. Some private placement bosses said that they have observed the A-share market in the past two decades and found that those who make a lot of money are long-term capital of enterprises that can strengthen their faith, remain optimistic and diligent, and adhere to high-quality growth in the face of difficulties.

and

Dan bin responded to the “short position” report: every major decision is not easy.

and

in the early morning of this morning, the securities firm China released the manuscript of “short position”. The reporter observed that hundreds of products of private placement boss Dan bin are suspected of short position or light position operation. Since March,

and

, danbin’s products have updated their net value three times, but the net value fluctuation of almost all products is close to 0.5% Other private placement products with updated net worth have retreated sharply due to the sharp decline in the market in March. According to this, the Chinese reporter of the securities firm speculated that Dan bin had significantly reduced his position as early as the end of February.

and

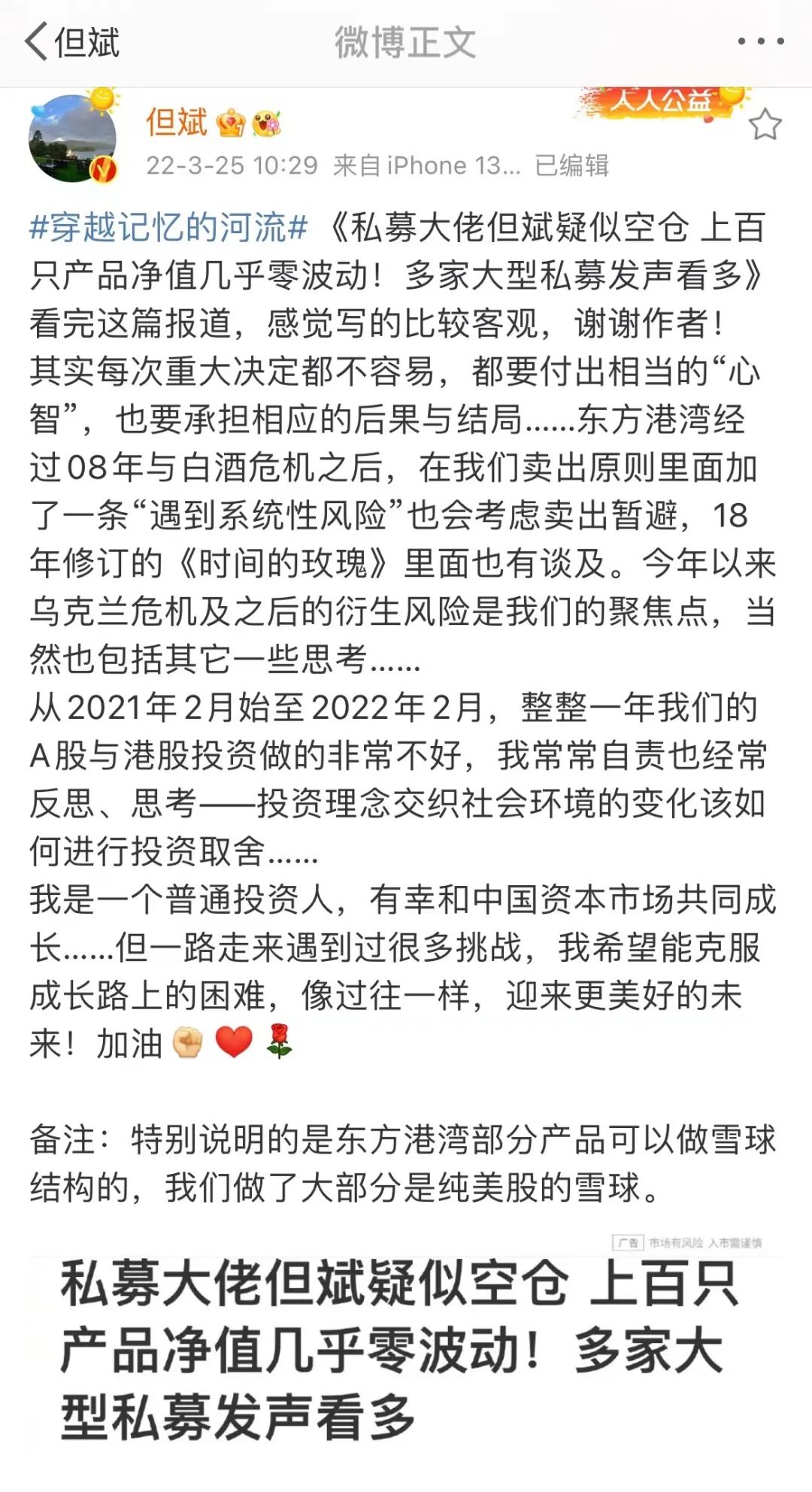

on the morning of March 25, Dan bin, chairman of Shenzhen Oriental harbor investment, responded to the report of “suspected short positions” through his personal microblog, saying that the report was written objectively. In fact, every major decision is not easy. We have to pay considerable “mental” and bear the corresponding consequences and outcomes. “From February 2021 to February 2022, our A-share and Hong Kong stock investments have been very bad for a whole year. I often blame myself and often reflect and think about how to make investment choices due to the intertwined investment ideas and the changes of social environment.”

and

later, Dan bin further said that the position was relatively low, about 10%.

and

on March 23, on the 18th anniversary of the founding of Dongfang harbor, Dan bin disclosed the capital scale of the company for the first time, saying that the current management scale of Dongfang harbor is close to 30 billion. If

and

are calculated at 10%, that is, Dan Bin’s current market value of position is about 3 billion yuan, and he still has 27 billion yuan of bullets in his hand. When to increase his position will also attract market attention.

and

for Dan Bin’s “short position”, many private placement told Chinese reporters of securities companies that on the one hand, their products have avoided the recent sharp decline in the market and the pain of passive position reduction due to excessive product withdrawal, which is a responsible attitude to customers; On the other hand, from the perspective of medium and long-term returns, it is currently the bottom area, and the risk of short positions is greater than that of high positions.

“timing increases the difficulty of investment, but if the timing is not completely selected, customers can’t stand it. It’s really difficult to do private placement to help others manage their money.” The person in charge of a private placement in Shenzhen said that Dan Bin’s low position may be difficult for the original group of long-term value investment believers to accept.

northbound capital and three major A-share indexes ended lower. Gem, agricultural stocks, bucked the market and strengthened. Shenzhen Component Index, Shanghai index and gem refer to

. 10 billion private placement leaders apologized. A number of private placement products may touch the early warning line

and

. This week, the stock market continued to fluctuate at a low level. On March 25, it fell 1.12%, hovering above 3200; The index fell 1.81%, while the index fell 2.52%.

and

with the continuous downturn of the market, a number of private placement products may touch the early warning line and liquidation line. According to the data of private placement network, as of March 25, there were 5842 securities private placement products with a cumulative net value of less than 0.85, 4162 securities private placement products with a cumulative net value of less than 0.8 yuan, and 2949 securities private placement products with a cumulative net value of less than 0.75 yuan.

and

generally speaking, the warning line of private placement products is about 0.85 and 0.8, and many products are about 0.75 If 075 as the standard, if 30% of the 2949 products have set an early warning line, 1000 products are also touched, which obviously increases the investment pressure of this part of private placement.

“products that touch the early warning line need to survive for a period of time because they dare not increase their positions easily and are worried that their mistakes will be liquidated.” The person in charge of a private placement in the south said.

and

this week, 10 billion private equity institution Shiva assets released a letter to investors, which also attracted market attention. Liang Hong, its leader, apologized to all investors for the temporary losses caused by the poor performance in the past year and his mistakes in all aspects.

and

in last week’s product weekly report, Liang Hong said that as six low net worth and fof products involved in the early warning line and the other fund was close to the liquidation line, it was forced to reduce some positions on Monday to meet the risk control requirements, resulting in a small break even or increase of these products last week.

and

in the volatile market environment, private placement products will inevitably have large net value fluctuations. Although the current market is very difficult, when most investors and institutions are unable to carry it, the market is often not far from the bottom. Many leaders of

and

spoke together: it has fallen to an all-time low, so there is no need to be pessimistic. A private placement leader of

and

said that after observing the A-share market in the past two decades, he found that those who make a lot of money are long-term capital of enterprises that can strengthen their faith, remain optimistic and diligent and stick to high-quality growth in the face of difficulties. Many positive signals of

and

are also emerging. On the one hand, it has taken out a lot of public investment and private placement funds; On the other hand, a number of stars have spoken privately to strengthen the confidence at the bottom of the market.

and

according to the incomplete data statistics of private placement network, nearly 50 public offerings have initiated self purchase since this year, and the actual self purchase amount has exceeded 2 billion yuan; More than 11 private placement managers announced self purchase, with a cumulative / proposed self purchase amount of more than 1.265 billion yuan, of which 9 are 10 billion private placement. Zou Yi, general manager of

and

red chip investment, pointed out at the communication meeting that from the perspective of stock risk premium (ERP), at present, a shares have fallen to a relatively low level in history, so there is no need to panic strategically in this position. The impact of negative factors may gradually decline in the future. The national “steady growth” is expected to drive the economy to develop in the second quarter. From the perspective of valuation and profit growth, a shares still have strong attraction in the world. This year, we should be patient with the market, remain optimistic in panic and adjust our positions.

Dong Chengfei, who has just joined Ruijun assets, said at a small channel internal communication activity: “after the withdrawal of high-quality enterprises in the market, the valuation has fallen back to a more reasonable range. Therefore, the market does not need to be too pessimistic this year. The future belongs to the transition period and low return period for a long time. Now is the stage of choosing future opportunities. If you choose well and wait patiently, you will finally get something.”

and

on March 24, vice president of trillion public offering Liu Gesong, the boss of top flow fund, said: “We should cherish the A-share assets in this position. There are such fluctuations in history, but not everyone can grasp them. After each round of sharp decline, high-quality stocks can provide more attractive buying opportunities and return on investment than ever before. Therefore, after the deep correction, there is no need to continue to be pessimistic at the bottom of the market. At present, we should think about which assets have been ‘killed by mistake’.”

(source: China securities firm)