Dali is coming! Personal income tax can be reduced for caring for infants under 3 years old, 1000 yuan per baby per month!, On March 28, in order to implement the decision of the CPC Central Committee and the State Council on optimizing Fertility Policies and promoting long-term balanced development of the population, in accordance with the relevant provisions of the individual income tax law of the people’s Republic of China, the State Council issued a notice and decided to establish a special additional deduction of individual income tax for the care of infants and young children under the age of 3., From January 1, 2022, the relevant expenses of taxpayers caring for infants and children under the age of 3 shall be deducted according to the standard quota of 1000 yuan per month for each infant and child before calculating and paying personal income tax., The relevant person in charge of the tax administration department of the Ministry of Finance and the income tax department of the State Administration of Taxation pointed out that the special additional deduction policy of personal income tax for the care of infants and young children under the age of 3, as one of the supporting measures to optimize the fertility policy, reflects the state’s encouragement and care for the people’s childbirth and upbringing, and is conducive to reducing the burden of the people on raising children. After the implementation of the policy, families with infants under the age of 3 will benefit from it.,

is coming! Caring for infants under 3 years old can reduce individual income tax, 1000 yuan per baby per month!

and

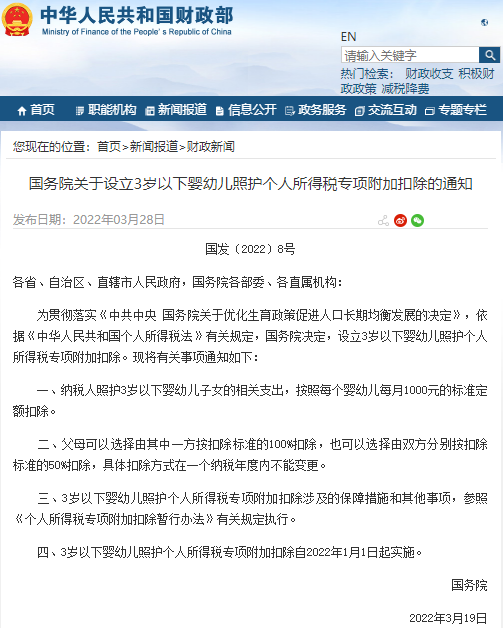

on March 28, in order to implement the decision of the CPC Central Committee and the State Council on optimizing Fertility Policies and promoting the long-term balanced development of the population, according to the relevant provisions of the individual income tax law of the people’s Republic of China, the State Council issued a notice and decided to establish a special additional deduction of individual income tax for the care of infants and young children under the age of 3.

and

from January 1, 2022, the relevant expenses of taxpayers caring for infants and children under the age of 3 shall be deducted according to the standard quota of 1000 yuan per month for each infant and child before calculating and paying personal income tax.

,  ,

,

the relevant person in charge of the tax administration department of the Ministry of Finance and the income tax department of the State Administration of Taxation pointed out that the special additional deduction policy of personal income tax for the care of infants and young children under the age of 3, as one of the supporting measures to optimize the fertility policy, reflects the state’s encouragement and care for the people’s childbirth and upbringing, and is conducive to reducing the people’s burden of raising children. After the implementation of the policy, families with infants under the age of 3 will benefit from it.

and

in addition, the Chinese reporter of the securities firm learned from the State Administration of taxation that in order to enable taxpayers to enjoy tax reduction dividends as soon as possible, the tax department has made all preparations, and the function of the special deduction reporting system was upgraded on the 28th. On March 29, eligible taxpayers can fill in the form through the mobile personal income tax app. Yang Chang, head of the policy group and chief analyst of

,  and

and

China Thailand Securities Research Institute, pointed out that according to the calculation, there are about 1.85 million infants and young children born between 2019 and 2021, and their parents can enjoy the “special additional deduction policy for the care of infants and young children under the age of 3”.

and

the State Council established a special additional deduction of individual income tax for the care of infants and young children under the age of 3.

and

as early as June 2021, the CPC Central Committee and the State Council issued the decision on optimizing Fertility Policies and promoting the long-term balanced development of the population, proposing to “study and promote the inclusion of the care expenses of infants and young children under the age of 3 into the special additional deduction of individual income tax”.

and

on March 28, the State Council issued the notice of the State Council on the establishment of special additional deduction of individual income tax for the care of infants and young children under the age of 3 (hereinafter referred to as the notice), and decided to establish special additional deduction of individual income tax for the care of infants and young children under the age of 3. Specifically:

I. the relevant expenses of taxpayers for caring for infants and children under the age of 3 shall be deducted according to the standard quota of 1000 yuan per month for each infant and child.

2. Parents can choose to deduct 100% of the deduction standard by one party or 50% of the deduction standard by both parties. The specific deduction method cannot be changed within a tax year. The safeguard measures and other matters involved in the special additional deduction of individual income tax for the care of infants and young children under the age of

and

shall be implemented with reference to the relevant provisions of the Interim Measures for special additional deduction of individual income tax.

and

special additional deduction of individual income tax for the care of infants and young children under 3 years old shall be implemented from January 1, 2022.

and

from January 1, taxpayers can enjoy

and

after “Declaration”. The current notice has been issued until the end of March. How can taxpayers declare this policy? Can the special additional deduction in the first three months of this year be enjoyed? In this regard, the relevant persons in charge of the tax administration department of the Ministry of Finance and the income tax department of the State Administration of Taxation explained. The aforementioned person in charge of

and

pointed out that the policy, like the other six special additional deductions, implements the service management mode of “Declaration can be enjoyed and data retained for future reference”. When declaring the enjoyment, taxpayers can fill in or provide the name, certificate type and number of infants and children, and the deduction distribution proportion between themselves and their spouses to the unit through the mobile personal income tax app, without submitting supporting materials to the tax authorities. Taxpayers need to keep their children’s birth medical certificates and other materials for future reference. In terms of deduction methods of

and

, according to the above-mentioned person in charge, the notice makes it clear that the policy will be implemented from January 1, 2022. In accordance with the relevant provisions of the individual income tax law, special additional deductions can be deducted in the month of declaration or supplemented when wages are paid in the following months; If there is no deduction for the salary paid at ordinary times, or if there is no employment unit, it can also be deducted when the final settlement is handled in the next year.

for example, if the taxpayer’s child is born in October 2021, the taxpayer will be eligible for special additional deduction from January 1, 2022. The taxpayer provided the infant information to the employer in April. When paying the salary in April, the unit can declare a special additional deduction of 4000 yuan from January to April for the taxpayer.

and

however, the above-mentioned person in charge reminded that the current comprehensive income settlement and payment summarizes the income and deduction information of taxpayers in 2021. The special additional deduction policy for infant care under the age of 3 will be implemented from 2022. Therefore, the special additional deduction for infant care cannot be filled in the current comprehensive income settlement and payment of individual income tax in 2021.

and

may benefit more than 1.8 million families.

and

the relevant person in charge of the tax administration department of the Ministry of Finance and the income tax department of the State Administration of Taxation pointed out that they are 3 years oldAs one of the supporting measures to optimize the fertility policy, the following special additional deduction policy for individual income tax on infant care reflects the state’s encouragement and care for the people’s fertility and is conducive to reducing the people’s burden of raising children. After the implementation of the policy, families with infants under the age of 3 will benefit from it. Yang Chang, head of the policy group and chief analyst of

and

China Thailand Securities Research Institute, said that according to estimates, more than 1.85 million infants and young children born between 2019 and 2021 can enjoy the “special additional deduction policy for the care of infants and young children under the age of 3”.

and

Yang Chang pointed out that due to the people involved in the special additional deduction of individual income tax, the first is the people who need to pay personal income tax. According to the data of the National Bureau of statistics in 2021, about 70.16 million people need to pay personal income tax, equivalent to 4.97% of the national population. According to the data of the National Bureau of statistics, the national birth population from 2019 to 2021 was about 37.27 million. If the age structure of 70.16 million people is assumed to be consistent with the age structure of the national population, the national consistent birth rate level is used. According to the proportion of 4.97%, the parents of more than 1.85 million infants born between 2019 and 2021 can enjoy the “special additional deduction policy for the care of infants under the age of 3”.

COVID-19, nucleic acid detection, relief, policy, tax rebate, financial subsidies, rent, Shanghai, subsidies, Shanghai Municipal People’s government office

, in addition, the responsible person also said that according to the current special additional deduction method, the taxpayers’ children aged 3 or above in pre-school education or full-time academic education stage, can be calculated according to the standard of 1000 yuan per child per month, before deducting the personal income tax deduction. Taxpayers who receive continuing education, rent or buy a house can enjoy special additional deductions such as continuing education, housing rent or housing loan interest; Taxpayers who are seriously ill themselves or their spouses or children can also apply for special additional deduction for serious illness medical treatment; Taxpayers who support their parents over the age of 60 can also enjoy a special additional deduction for supporting the elderly.

who can enjoy the policy? How to fill in?

and

on March 28, the relevant persons in charge of the tax administration department of the Ministry of Finance and the income tax department of the State Administration of Taxation answered the reporter’s questions on the implementation of the special additional deduction of individual income tax for the care of infants and young children under the age of 3. The income tax department of the State Administration of Taxation issued the “Q & A on the tax handling of special additional deduction for the care of infants and young children under the age of 3”, specifically eight questions and eight answers.

I. what is the background and significance of the special additional deduction policy for personal income tax of infant care under 3 years old?

and

in June 2021, the CPC Central Committee and the State Council issued the decision on optimizing Fertility Policies and promoting the long-term balanced development of the population, which proposed to “study and promote the inclusion of infant care expenses under the age of 3 into the special additional deduction of individual income tax”. This is a major decision made by the Party Central Committee and the State Council in accordance with the changing situation of China’s population development. It is a major measure to promote long-term balanced population development and promote high-quality development. As one of the supporting measures to optimize the fertility policy, the special additional deduction policy of personal income tax for the care of infants and young children under the age of 3 reflects the state’s encouragement and care for the people’s fertility and is conducive to reducing the people’s burden of raising children. After the implementation of the policy, families with infants under the age of 3 will benefit from it.

what are the main contents of the special additional deduction policy for the care of infants and young children under the age of 2 and 3? The policy of

and

stipulates that from January 1, 2022, the relevant expenses of taxpayers caring for infants and children under the age of 3 shall be deducted according to the standard quota of 1000 yuan per infant per month before calculating and paying personal income tax. In terms of specific deduction methods, the husband and wife can choose to deduct 100% of the deduction standard, or the husband and wife can choose to deduct 50% of the deduction standard respectively. If the guardian is not a parent, it can also be deducted according to the above policies.

III. how can taxpayers enjoy the policy from January 1, 2022?

and

the notice specifies that the policy will be implemented from January 1, 2022. In accordance with the relevant provisions of the individual income tax law, special additional deductions can be deducted in the month of declaration or supplemented when wages are paid in the following months; If there is no deduction for the salary paid at ordinary times, or if there is no employment unit, it can also be deducted when the final settlement is handled in the next year. For example, if the taxpayer’s child is born in October 2021, the taxpayer will meet the conditions for special additional deduction from January 1, 2022. The taxpayer provided the infant information to the employer in April. When paying the salary in April, the unit can declare a special additional deduction of 4000 yuan from January to April for the taxpayer. How do the

and

special additional deduction policies for the care of infants and young children under the age of 4 and 3 connect with the current six special additional deduction policies? After the implementation of the special additional deduction policy of

and

for the care of infants and children under the age of 3, the relevant expenses of taxpayers for the care of infants and children under the age of 3 shall be deducted in a fixed amount before the calculation and payment of personal income tax according to the standard of 1000 yuan per child per month. In addition, according to the provisions of the current special additional deduction method, if the taxpayer’s children are over the age of 3 and are in the stage of preschool education or full-time academic education, they can be deducted according to the standard of 1000 yuan per child per month. Taxpayers who receive continuing education, rent or buy a house can enjoy special additional deductions such as continuing education, housing rent or housing loan interest; Taxpayers who are seriously ill themselves or their spouses or children can also apply for special additional deduction for serious illness medical treatment; Taxpayers who support their parents over the age of 60 can also enjoy a special additional deduction for supporting the elderly. On the whole, these seven special additional deduction policies basically consider the burden of taxpayers in different stages. Can the special additional deduction of

and

for the care of infants and young children under the age of 5 and 3 be declared in the current final settlement of individual income tax in 2021? The current comprehensive income settlement and payment of

and

summarizes the income and deduction information of taxpayers in 2021. The special additional deduction policy for infant care under the age of 3 has been implemented since 2022. Therefore, the special additional deduction for infant care cannot be reported to the current individual income tax in 2021The comprehensive income is being settled and paid.

VI. do you need to submit information to enjoy the special additional deduction for the care of infants and young children under the age of 3?

and

special additional deductions for the care of infants and young children under the age of 3 are the same as the other six special additional deductions, and the service management mode of “Declaration can be enjoyed and data retained for future reference” is implemented. When declaring the enjoyment, taxpayers can fill in or provide the name, certificate type and number of infants and children, and the deduction distribution proportion between themselves and their spouses to the unit through the mobile personal income tax app, without submitting supporting materials to the tax authorities. Taxpayers need to keep their children’s birth medical certificates and other materials for future reference.

and

VII. How to fill in the special additional deduction if the taxpayer has not obtained the infant birth medical certificate and other materials yet?

taxpayers have not yet obtained the birth certificate and the ID number of the infants, and can choose other personal documents, and fill in the relevant information in the notes, without prejudice to the deduction of the taxpayers. Subsequent taxpayers obtain the birth certificate or the ID number of the infant, and update it in time. If the infant’s name is Chinese passport, foreign passport, mainland pass for Hong Kong and Macao residents, mainland pass for Taiwan residents and other identity document information, it can also be used as the filling certificate.

8. Now it is the end of March. How can taxpayers supplement and enjoy the special additional deduction in the previous month?

if taxpayers want to enjoy the special additional deduction for the care of infants and young children under the age of 3 when paying wages and salaries, they can fill in the deduction information through the mobile personal income tax app and choose to push it to the employment unit. After the unit updates the taxpayer’s deduction information in the tax system, it will automatically deduct the cumulative deduction for taxpayers from the qualified month to the reporting month at the next salary payment; If taxpayers want to enjoy it again during the final settlement in 2022, they can also supplement the special additional deduction of eligible months through the annual final settlement from March 1 to June 30, 2023.

for example, if the taxpayer’s child is born in October 2021, the taxpayer will meet the conditions for special additional deduction from January 1, 2022. The taxpayer will provide the infant information to the employer in April, and the employer can declare the special additional deduction of 4000 yuan from January to April for the taxpayer when paying the salary in April; If the taxpayer’s child is born in February 2022, the taxpayer will meet the conditions for special additional deduction from February 2022. When paying the salary in April, the unit can declare a special additional deduction of 3000 yuan accumulated from February to April for the taxpayer.

related report

how to declare the special deduction of individual income tax for the care of infants under 3 years old? Note that the three messages

and

weigh heavily! The special additional deduction of personal income tax for the care of infants under 3 years old is coming! How to declare? Interpretation of

and

by the Ministry of Finance and the State Administration of Taxation